How to spot a good property investment opportunity

Investing in real estate in Southern Spain can be a lucrative venture if done wisely. The key to success lies in identifying the right property investment opportunity that aligns with your financial goals. While there are many factors to consider, such as location, valuation, and expected cash flows, it is essential to conduct thorough research and analysis before making any investment decisions.

In this comprehensive guide, we will explore the key elements to look for when spotting a good property investment opportunity. From evaluating the neighborhood and property taxes to assessing the job market and amenities, we will delve into the critical factors that can make or break your investment. So let’s dive in and discover the secrets to identifying a profitable real estate venture.

READ ALSO: http://terrasurhomes.com/how-to-roi-in-real-estate/

1. Neighborhood: The Foundation of a Successful Investment

The neighborhood in which a property is located plays a crucial role in determining its potential for success. Consider factors such as livability, amenities, and the target tenant market. Research the area thoroughly to understand its attributes and drawbacks. For example, if the property is near a university, it may attract students as tenants, but vacancies could be a challenge during the summer months. Additionally, be aware of any rental conversion restrictions imposed by the local authorities, as they can impact your investment plans.

2. Property Taxes: Balancing Costs and Returns

Property taxes are an unavoidable expense for property owners. Assess the property tax rates in your target area to understand the potential impact on your cash flow. While high property taxes may not always be detrimental, as they could indicate a desirable neighborhood attracting long-term tenants, it is essential to be aware of any future tax increases that could erode your rental income. Stay informed about the financial health of the municipality to anticipate any potential tax hikes that may affect your investment.

3. Schools: A Crucial Consideration for Family-Sized Homes

For family-sized homes, the quality of local schools can significantly impact the value and demand for your rental property. Good schools in the vicinity can attract families, increasing the desirability and potential rental income of your investment. Conversely, a lack of quality educational institutions nearby may limit the value appreciation and demand for your property. Therefore, it is crucial to consider the school district’s reputation and performance when evaluating a property investment opportunity.

4. Crime: Ensuring a Safe and Secure Environment

Nobody wants to live in an area plagued by crime. Assess the crime statistics of the neighborhood to gauge its safety and security. Utilize online resources, local police departments, and public libraries to access accurate crime data for the area. Look for trends, such as declining crime rates or increased police presence, as these indicators can provide insights into the overall safety of the neighborhood. A secure environment not only attracts tenants but also helps maintain the long-term value of your investment.

5. Job Market: Driving Demand and Rental Income

A thriving job market is crucial for attracting tenants to your rental property. Research the employment opportunities in the area to gauge its growth potential. The local authorities can provide valuable information on job availability and economic trends. Keep an eye out for companies relocating or expanding in the area, as this can signal increased demand for rental properties. However, consider the specific industry involved, as it can impact housing prices and rental rates.

For more info: https://ppandalucia.es/en/andalucia/empleo/

6. Amenities: Enhancing the Desirability of the Neighborhood

The presence of amenities can significantly impact the attractiveness of a neighborhood to potential tenants. Take a thorough tour of the area to identify parks, restaurants, gyms, movie theaters, and public transportation links. City Hall or local promotional literature can provide valuable insights into the blend of public amenities and private property in the neighborhood. Properties located in areas with a wide range of amenities are more likely to attract tenants and offer potential for long-term appreciation.

mesas homes area in Estepona – a popular neighbourhood for property investment

7. Future Development: Evaluating Growth and Potential Risks

Stay informed about future development plans in the area by consulting the municipal planning department. Understanding the zoning and approved projects can help you assess the potential for growth. However, be cautious of developments that could negatively impact surrounding properties or create an oversupply of housing in the market. Additional housing units may compete with your property, affecting rental rates and the overall demand for rentals in the area.

8. Number of Listings and Vacancies: Assessing Market Dynamics

The number of available listings and vacancy rates in a neighborhood can provide valuable insights into its market dynamics. High vacancy rates may indicate a seasonal cycle or a declining neighborhood, necessitating lower rental rates to attract tenants. On the other hand, low vacancy rates allow landlords to increase rental prices. Research this data to understand the demand and supply dynamics of the market, enabling you to make informed decisions about rental rates and the potential profitability of your investment.

Tip: Check booking.com and Airbnb for the best results in designated areas.

9. Average Rents: Determining Income Potential

Rental income is the lifeblood of your investment, making it crucial to understand the average rent in the area. If the rental income is insufficient to cover your mortgage payment, taxes, and other expenses, your investment may not be financially viable. Research the local rental market to determine the rental rates for properties similar to the one you are considering. Additionally, project the future trends in the rental market to ensure the sustainability of your investment.

Spain 2nd most attractive property destination for international investors

10. Natural Disasters: Protecting Your Investment

Consider the potential risks posed by natural disasters in the area. If the property is located in an earthquake or flood-prone region, insurance coverage costs may significantly impact your rental income. Evaluate the potential risks and associated insurance costs to protect your investment and ensure its long-term profitability. Seek professional advice and consider the long-term implications of natural disasters on the property’s value and rental demand.

11. Additional Income Property Tips

In addition to the key factors mentioned above, here are some additional tips to help you navigate the property investment landscape:

- Begin your search independently before involving a real estate agent. This allows you to thoroughly understand your requirements and preferences.

- Talk to neighbors, both homeowners and renters, to gain insights into the neighborhood’s strengths and weaknesses.

- Consider the type of property that suits your investment goals. Single-family dwellings or condominiums are often recommended for beginners due to lower maintenance requirements and potential for long-term tenants.

- Evaluate the appreciation potential of the property by assessing its current condition and the potential for cosmetic improvements that can attract higher-paying tenants.

- Ensure the property is reasonably priced by comparing it to similar properties in the area and analyzing recent selling prices.

- Calculate your total costs, including mortgage payments, taxes, insurance, and maintenance, to determine if the property will generate positive cash flow.

- Consider hiring a property management company if you prefer a hands-off approach. Make sure to account for the management fees in your financial projections.

12. Making the Purchase: A Well-Informed Decision

When you have identified a promising property investment opportunity, it’s time to make a well-informed purchase. Be prepared to meet the lending requirements for investment properties, which often involve higher down payments and stricter lending criteria compared to primary residences. Hire professionals to conduct thorough inspections and review legal documents before finalizing the purchase. Additionally, secure appropriate landlord insurance to protect your investment and mitigate potential risks.

In conclusion, identifying a lucrative property investment opportunity requires comprehensive research and analysis. By considering factors such as the neighborhood, property taxes, schools, crime rates, job market, amenities, future development plans, vacancy rates, average rents, and natural disaster risks, you can make informed investment decisions. Remember to conduct due diligence, seek professional advice when needed, and align your investment strategy with your financial goals. With careful consideration and planning, real estate investment can offer long-term financial benefits and contribute to a diversified portfolio.

TerraSur Homes

Are you ready to make a wise investment that will secure your financial future? Look no further than TerraSur Homes, your ultimate real estate partner. With their expertise and knowledge in the industry, they are the go-to company for spotting a good property investment opportunity. Whether you are a first-time investor or a seasoned one, TerraSur Homes has got you covered.

What sets TerraSur Homes apart from other real estate agencies is their commitment to finding the best property investment opportunities for their clients. They have an extensive network of contacts and resources that allow them to stay ahead of the game and identify properties with great potential. From residential homes to commercial buildings, they have a wide range of options to suit every investor’s needs.

Contact us for Costa del Sol investments

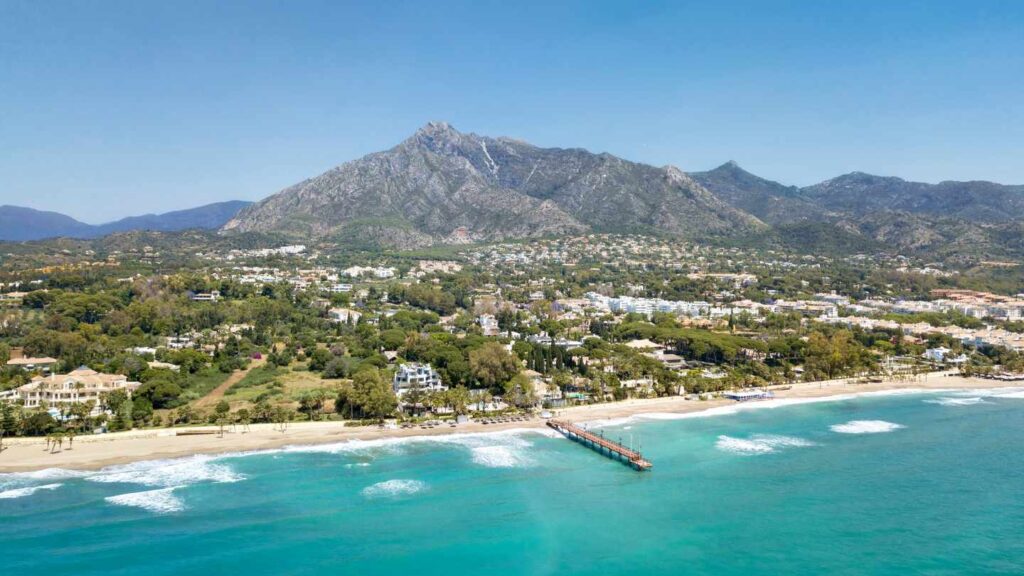

When it comes to property investment in the Marbella area, timing is everything. With TerraSur Homes by your side, you can rest assured that you will always be one step ahead of the competition. Their team of experts closely monitors market trends and analyses data to identify emerging opportunities. They know when to buy and when to sell, ensuring that you get the maximum return on your investment.

But it’s not just about finding a good property investment opportunity with TerraSur Homes. They also provide comprehensive support throughout the entire investment process. From conducting due diligence to negotiating the best deal, their experienced team will guide you every step of the way. They understand the risks involved in property investment and will help you make informed decisions.

So why wait? Take advantage of TerraSur Homes’ expertise and start building your real estate portfolio today. With their help, you can spot a good property investment opportunity and make a smart financial move. Trust in their knowledge, experience, and dedication to helping you achieve your investment goals. Don’t miss out on this exciting opportunity to secure your financial future. Contact TerraSur Homes now!

Similar news

Get your comprehensive guide to buying property